IR-2015-124, Nov. 5, 2015 Español

WASHINGTON — While there is still time before the next tax filing season, choosing a return preparer now allows more time for taxpayers to consider appropriate options and to find and talk with prospective tax preparers rather than during tax season when they’re most busy. Furthermore, it enables taxpayers to do some wise tax planning for the rest of the year. If a taxpayer prefers to pay someone to prepare their return, the Internal Revenue Service encourages them to choose that person wisely as the taxpayer is legally responsible for all the information included on the return.

This is the third in a series of weekly tax preparedness releases designed to help taxpayers begin planning to file their 2015 return.

Below are some tips taxpayers can keep in mind when selecting a tax professional:

Select an ethical preparer. Taxpayers entrust some of their most vital personal data with the person preparing their tax return, including income, investments and Social Security numbers.

Ask about service fees. Avoid preparers who base their fee on a percentage of the refund or those who say they can get larger refunds than others. Taxpayers need to ensure that any refund due is sent to them or deposited into their bank account, not into a preparer’s account.

Be sure to use a preparer with a preparer tax identification number (PTIN). Paid tax return preparers must have a current PTIN to prepare a tax return. It is also a good idea to ask the preparer if they belong to a professional organization and attend continuing education classes.

Research the preparer’s history. Check with the Better Business Bureau to see if the preparer has a questionable history. For the status of an enrolled agent’s license, check with the IRS Office of Enrollment (enrolled agents are licensed by the IRS and are specifically trained in federal tax planning, preparation and representation). For certified public accountants, verify with the state board of accountancy; for attorneys, check with the state bar association.

Ask for e-file. Any paid preparer who prepares and files more than 10 returns for clients generally must file the returns electronically.

Provide tax records. A good preparer will ask to see records and receipts. Do not use a preparer who is willing to e-file a return using the latest pay stub instead of the Form W-2. This is against IRS e-file rules.

Make sure the preparer is available after the filing due date. This may be helpful if questions come up about the tax return. Taxpayers can designate their paid tax return preparer or another third party to speak to the IRS concerning the preparation of their return, payment/refund issues and mathematical errors. The third party authorization checkbox on Form 1040, Form 1040A and Form 1040EZ gives the designated party the authority to receive and inspect returns and return information for one year from the original due date of the return (without regard to extensions).

Review the tax return and ask questions before signing. Taxpayers are legally responsible for what’s on their return, regardless of whether someone else prepared it. Make sure it’s accurate before signing it.

Never sign a blank tax return. If a taxpayer signs a blank return the preparer could then put anything they want on the return — even their own bank account number for the tax refund.

Preparers must sign the return and include their PTIN as required by law. The preparer must also give the taxpayer a copy of the return.

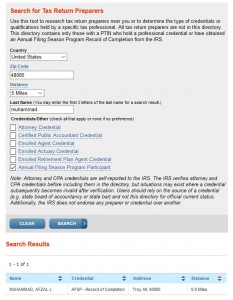

Find my name as professional tax preparer on IRS website

Find AFSP Professional Tax Preparer on IRS Website